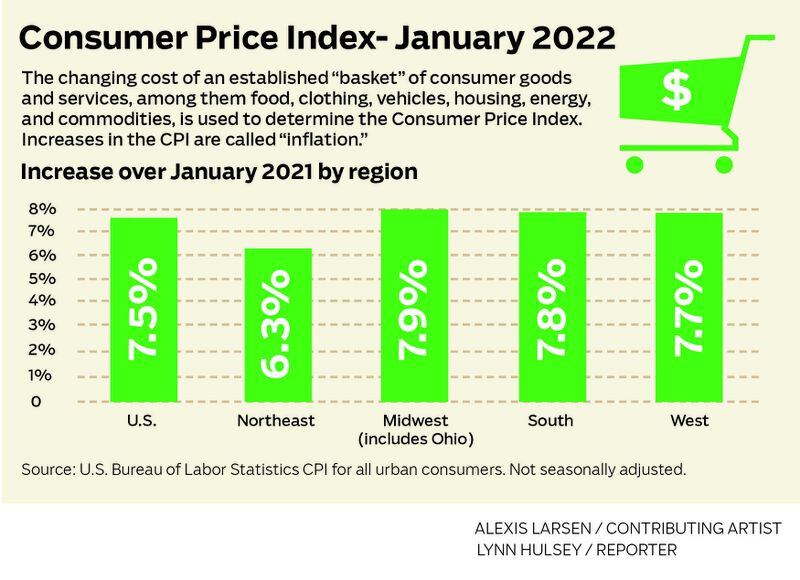

According to the U.S. Bureau of Labor Statistics, inflation, as measured by the consumer price index (CPI), was up to 8.5% from March 2021 to March 2022. In a nutshell, this means that prices on the total of all goods and services we buy are up an average of 8.5% over the past year.

Inflation can negatively impact business owners in many ways, but the most simple impacts include a decrease in demand and an increase in the cost to run a business. For example, due to inflation consumers often must start making trade-offs to balance their budgets as prices go up. They can afford 8.5% less than what they used to, so some things will need to be cut or reduced from their spending. Additionally, as things get more expensive to make, prices are increased, causing a ripple effect throughout the economy. Ultimately, less demand and higher prices can negatively impact a business’s bottom line.

While inflation can be painful, businesses can take proactive measures like those listed below to minimize inflation’s impact on their business and maintain their bottom line.

Buy in Bulk

Inflation can hurt a small business but can encourage business owners to seek the best pricing. Take this time to review your materials and supplies costs and check if you are getting the lowest unit cost. If you have the cash, you may look for bulk buying discounts and stock up on items that are rising in price or have limited availability.

Stockpile

Don’t you wish you could take a time machine back a few years and stock up on fuel? While we don’t recommend stockpiling gasoline (talk about a fire hazard), you can use the same mindset to stock up on products you believe will only be going up in price or may be subject to a supply chain disruption. For example, lumber prices have been rising rapidly, but if a builder pre-purchased lumber and stockpiled it, they’d have locked in great pricing and thus higher profits than their competitors.

Don’t Overstock

If you are unsure as to whether or not certain items will sell, don’t overstock them. While stockpiling can be helpful when you’re confident you’ll sell an item or use a raw material, overstocking can lead to a waste of space and decreased profits, so try to avoid overstocking unless you’re confident you’ll use your stockpile.

Opt for Fixed Interest Rates

The Federal Reserve has been hiking interest rates significantly in the past months. If you have contracts or lines of credit with variable interest rates, it’s time to rethink those. Interest rates will likely continue going up, so locking in fixed interest rates before they rise can help you save money.

Know Your Costs

One mistake many business owners make is forgetting to recalculate their true costs from time to time. During inflationary periods this is especially important because many business expenses are on the rise. Once you have a clear picture of your true costs in this economic environment, you can make business decisions to protect your business and maintain your bottom line.

Adjust Your Pricing

Equally as important as knowing your costs is adjusting your pricing. If your costs rise and your prices stay the same, your profits will get pinched. Sometimes, your business or certain products or services may no longer be profitable. One way to counteract rising costs is to raise your pricing to maintain profitability.

Retain Top Talent

It can be expensive to hire a new employee and get them trained. Also, with the low supply of quality labor, new employees often come at a premium price. To avoid the costs associated with hiring new people, it’s best to retain your top talent. You may want to offer raises or additional benefits, but it doesn’t always have to be about money. For example, you can work on creating a strong culture and a workplace that people enjoy coming to or continue to allow employees the freedom to work from home.

Rethink Labor Costs

While retaining top talent is important, you may also want to consider rethinking other labor costs that aren’t necessary or aren’t necessary full-time. For example, you could look to hire independent contractors instead of employees. Depending on the project you need to be completed, it may be less expensive to have an independent contractor complete a project for you than having a full-time employee who also requires benefits.

Shorten Timelines for Quotes

With costs rising, it’s important to manage those for your business. One way to do this is to reduce the timeline when you give your customers quotes. This will allow you more flexibility to update pricing to match your supply costs.

Rethink Marketing

Marketing is an important part of a business. However, your marketing tactics may need to evolve as economic factors change. It’s important to evaluate your marketing efforts to ensure they’re producing a positive ROI. For example, you may have had a marketing tactic that worked a year ago but is no longer producing a quality return. If that is the case, it may be time to test a new marketing method and abandon the one that is no longer working.

Look for Grants

Depending on where your business is located, business grants may still be available for you. You can call your local Small Business Development Center office and ask them if they know of any business grants available for business owners in your region. Injecting capital into your business can help you survive until inflation goes back down.

Pivot

Businesses exist to solve problems for people or other businesses. If revenue and profits are starting to dry up, it may be time to pivot. For example, you can look at your current customers and assess their current needs. You may find that your customers needed one thing a year ago, but now their needs have changed. Savvy business owners know change is inevitable, and they stay on top of trends to continue solving problems for their clients.